The VTC business attracts many self-employed drivers, but many soon find that their sales have plateaued. With inflation, longer waiting times and increased competition, real hourly earnings have fallen in recent years. To remain profitable, it is no longer enough to accumulate hours behind the wheel: you need to structure your business, control your costs and diversify your income.

This article gives you some practical tips on how to turn a business that's "just running" into an optimised one.

The essentials in a nutshell

No time to read the whole article? Here's a quick summary of the key points:

-

Calculate your real indicators: effective revenue per hour, cost per kilometre and occupancy rate.

-

Work the right slots (peak hours, weekend nights, events) and the right areas (stations, airports, business districts).

-

Multiply your channels: several apps, partnerships with businesses and hotels, private customers at €2/km incl. tax.

-

Reduce your costs by choosing the right status (see our article how to choose between micro-enterprise, EI, EURL and SASU status) and deducting your costs (see what expenses can you deduct).

-

Look after your vehicle: a hybrid is still a good compromise, while electric is more cost-effective if your schedule and charging points allow (see our analysis of the profitability of VTC electric cars).

Understanding your figures: the basis for optimisation

You can only optimise what you can measure. A few indicators are all you need to manage your business:

- Effective hourly income Include not only running time, but also waiting time and empty runs.

- Occupancy rate Ratio of minutes running to minutes logged.

- Cost per kilometre Add up fuel/energy, maintenance, insurance, tolls, parking, vehicle depreciation and platform commission.

- Medium basket : average value for a journey, useful for tracking the split between short and long journeys.

A profitable driver monitors these figures every week to adjust his strategy.

Earning more without driving more

Working longer hours is not always the right answer. The real lever is to target the times and places where demand is highest.

- Key niches Weekdays (7am-9am and 5pm-8pm), Thursday evenings (afterworks), Fridays and Saturdays all night, Sunday mornings (after parties).

- Strategic zones stations, early morning airports, business districts, event venues (trade fairs, concerts, conferences).

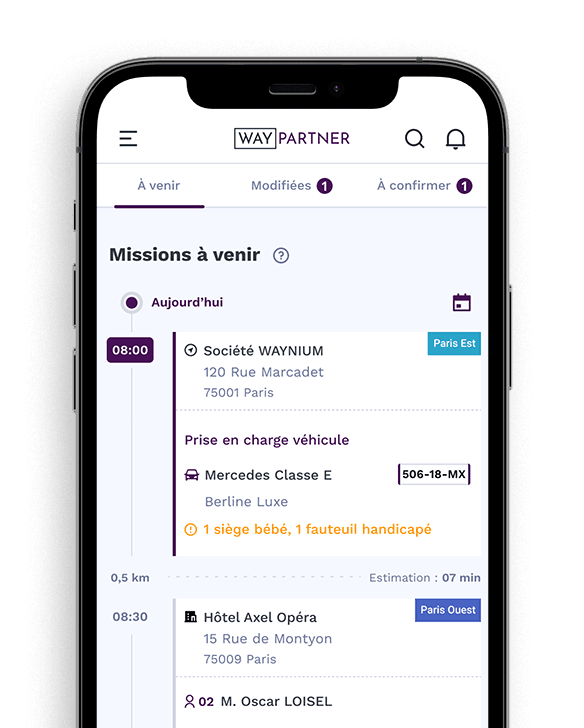

- Multi-apps Alternating between platforms reduces downtime and lets you take advantage of each platform's bonuses.

- Private clients The aim is to achieve a direct price of €2/km including tax, with simple packages (e.g. airport shuttles). This is the best way of limiting dependence on platforms and their commissions.

- Premium service An impeccable vehicle, a bottle of water, a phone charger and a smooth drive will increase your tips and improve your visibility in the apps.

Reducing costs intelligently

Optimising your income depends as much on what you earn as on what you keep.

- Choice of status Micro-enterprises are suitable for start-ups or secondary activities, but can quickly become restrictive for full-time operations. If you convert to a company (SASU, EURL, EI), you will benefit from real tax optimisation. See our article: how to choose your status.

- VAT VAT: reduced rate of 10 % on journeys with a known distance/destination, 20 % on hourly hire (events, weddings). As a company, you can reclaim VAT on your business expenses.

- Deductible expenses These include fuel, insurance, maintenance, software, meals for professionals, telephone charges, a chartered accountant... and even a share of the accommodation if you locate your business there. See more : what expenses can you deduct.

- Forgotten benefits CESU (up to €2,421 per year), holiday vouchers (€530), tax credit for manager training (up to €932 reimbursed per year).

The vehicle: a work tool, not just a car

Your car determines your profitability. Here are a few simple guidelines:

- Hybrid Robust, economical and very popular with drivers to start with.

- Electric Electricity: cost-effective if your business can adapt to the range and charging points available. The cost of energy is up to three times less than fuel, and maintenance is reduced. See more : Electric cars for VTCs: still profitable in 2025.

- Method of financing Purchase, LOA, LLD... Each option has its advantages. See more : What type of financing should you choose: Purchase, LOA or LLD?.

Common mistakes to avoid

Many drivers lose money by falling into these traps:

- Driving without knowing how much a kilometre really costs.

- Passively waiting for a race to fall without positioning yourself.

- Neglecting vehicle cleanliness and maintenance.

- Forgetting to keep expense receipts.

- Working without a clear hourly or weekly income target.

Conclusion

Optimising your VTC income doesn't mean adding hours of work, it means choosing your slots, customers and status intelligently. By monitoring your figures, controlling your costs and diversifying your income, you can turn a fragile business into a truly profitable one.

Glossary

Here are some useful terms to know and understand:

-

ARPE Autorité des Relations Sociales des Plateformes d'Emploi, a public body that analyses drivers' activities and organises social dialogue.

-

Cost per kilometre Actual cost of a kilometre driven, including fuel/energy, maintenance, insurance, depreciation and unladen kilometres.

-

SASU Société par Actions Simplifiée Unipersonnelle, a form of company with a single shareholder, enabling the separation of business and personal assets and the deduction of all actual expenses.

-

Micro-business Simplified scheme: taxed on sales after a flat-rate allowance, without the option of deducting actual expenses.

-

VAT Value added tax. Reduced rate of 10 % on most services, 20 % for hourly services.

-

CESU Chèque Emploi Service Universel, financed by the company to pay for personal services (cleaning, childcare, etc.).

-

Holiday vouchers : assistance financed by the company to pay for leisure activities and holidays, exempt from tax and contributions.

-

Executive training tax credit tax advantage for company directors (excluding micro) who take a training course, up to €932 per year.